FORECLOSURE LAWYER HARTFORD

If you’re a Hartford, CT homeowner worried about your mortgage payments and even fearful of foreclosure, you’re not alone. Thousands of Hartford, CT homeowners continue to struggle with the economic upheaval of the past few years and many families fight monthly to try to stay current on their mortgage payments. Many Hartford homeowners have faced extreme personal and financial hardships and have even been forced to miss mortgage payments or enter into agreements with their Banks or mortgage companies for forbearance and mortgage modifications. As the Hartford, CT foreclosure court ramps up after a pandemic shut-down, hundreds of Hartford residents will receive mortgage demand letters and foreclosure lawsuits. Pending foreclosure actions are also being renewed by aggressive Bank attorneys and foreclosure factories eager to take your family home.

Fortunately, as Hartford, CT foreclosure defense lawyers, we know that your home is savable with the proper advice and prompt action of the Hartford foreclosure defense attorneys at the Law Offices of Neil Crane.

At the Law Offices of Neil Crane, we have been fighting for homeowners as foreclosure lawyers in Hartford, CT since 1983. We have successfully defended thousands of foreclosures throughout the Hartford area as the largest specialized foreclosure defense and bankruptcy relief attorneys in Connecticut. We are a team of long-term attorneys and other supporting professionals who fully understand all the options for preventing home loss and stopping all types of foreclosures in Hartford, CT.

Over the past 37 plus years, we’ve saved homes in all the foreclosure courts in CT. We’ve successfully defended our clients and saved homes against every bank and foreclosure lawyer in CT. Our reputation for excellence on behalf of our clients is known by every foreclosure lawyer in Hartford, CT. While it’s never too late to get started – do it soon and don’t go it alone. The hardest step is to seek help. It’s scary to call for help, but you and your home deserve the best result possible. You need to learn about all the strong state and federal laws written to help homeowners. It just takes one free call to the Hartford foreclosure defense attorneys at the Law Offices of Neil Crane.

At the Law Offices of Neil Crane, all our Hartford, CT foreclosure clients speak directly with Attorney Neil Crane. He and his team of experienced attorneys have saved more homes from foreclosure than any other attorneys in Connecticut. We don’t use voicemail.

Legal Avenues to Save Your Home from Foreclosure

Whether you’re a bit behind on your payments or deep into the foreclosure process, strong legal options are available for your protection, but you need to know the laws and not go it alone. Banks and bank attorneys are powerful and intimidating – You need to even the playing field and not experiment with your own home. You need the best, experienced legal representation possible. At the Law Offices of Neil Crane, we know your legal rights and how to use all the laws available to save your home from foreclosure. You just need to give us a free call and speak directly with Attorney Neil Crane about:

Forbearance: This is a process whereby your bank will hold off on starting or continuing a foreclosure or collection action for a set period of time while you’re unable to make your payments. It can be a great thing for homeowners in trouble, but it’s only temporary. A forbearance is temporary relief, not a permanent solution. The real question is, what happens after a forbearance. Since you don’t pay during a forbearance period, your back balance will increase and often can become unmanageable when the forbearance period is over. Our Hartford, CT foreclosure attorneys know how to turn a temporary forbearance into a solid modification that will permanently save your home.

Foreclosure Mediation: All residential foreclosures in Hartford, CT are entitled to court-sanctioned foreclosure mediation. Foreclosure mediation on your own is a trap you need to avoid at all costs. Foreclosing banks and court mediators don’t work for you, they work against you. Since they all work with banks to foreclose your home, they don’t want you to get professional legal help. They never encourage you to learn your rights or get your own attorney. They avoid the hard solutions and just comfort you to provide you with a false sense of security as they move forward to take your home. Without the assistance and expertise of a Hartford foreclosure lawyer on your side, novice homeowners have lost thousands of savable homes in the Hartford foreclosure court alone. Successful mediation requires experienced Hartford foreclosure defense experts specializing in home retention and overall debt relief.

Mortgage Modification: If you’re behind on your mortgage payments or facing a foreclosure due to past-due payments, favorable mortgage modification can resolve past -due payments, lower interest rates and prevent or solve a foreclosure. The key to obtaining solid mortgage modification is a well-drafted Modification Application and an effective plan that avoids bank delay and red tape. Novice homeowners in trouble need to get educated and learn all the options and avenues available by consulting an experienced Hartford foreclosure attorney.

To secure your successful mortgage modification, our special Hartford foreclosure defense attorneys understand what your bank needs to see to approve your mortgage modification:

- We formulate or author a solution that will work right for your circumstances and still get your bank’s approval.

- We act promptly on behalf of our clients understanding that swift contact with your bank should always happen sooner rather than later.

- We understand the importance of reviewing your entire financial situation in a comprehensive customized plan to reorganize and solve your mortgage problems. We address and tackle all household problems that can threaten your ability to make consistent on-time mortgage payments.

- We understand that saving missed payments and creating a cash reserve can be the key to mortgage solutions and long-term stable home ownership.

Put our years of specialized knowledge to work for you and your family. Foreclosure prevention solutions require our commitment to your success and our specialized knowledge as foreclosure defense attorneys in Hartford, CT.

Comprehensive Debt Reduction Saves Hartford Homes from Foreclosure

Many homeowners in trouble continue to struggle with debts that prevent them from properly addressing their mortgage problem. Solving overall household debt problems is an essential element to any long-term mortgage solution.

Chapter 7 stops mortgage defaults and provides the comprehensive debt relief that creates all sorts of mortgage options.

Chapter 13 Bankruptcy law prevents banks from continuing any form of mortgage demands, collection efforts or foreclosure proceeding through the creation of an automatic stay immediately upon filing. Banks and all creditors are prevented by federal law from taking any efforts to collect against you or threaten your home. Chapter 13 allows homeowners behind on their mortgage payments or in foreclosure to just start over. Current payments must be accepted as current and old payments are restructured over five years without your bank’s assistance or permission.

Chapter 13 is a collection of different but coordinated laws or “Sections” which come together to create a system that immediately stops all foreclosures at whatever stage and provides a clear process for an experienced Chapter 13 lawyer to reorganize your mortgage payments and prevent the loss of your Hartford, CT area home. It requires no Bank approval or permission and doesn’t control your budget or even require your presence in court. Chapter 13 is a federally-funded and efficiently administered protection for homeowners that assures the current payment of mortgages by Federal law and Federal protection. The law was written to empower homeowners and even the playing field in favor of individuals and not banks.

Chapter 13 controls all forms of debt eliminating or reducing unnecessary debt like credit cards and other non-house payments in favor of regular monthly home payments. It is the most powerful group of laws available to individuals in all states across the country. The Chapter 13 system is one of the best run systems in the country and it’s there to help people just like you.

Every year, hundreds of Hartford area foreclosures are solved by Chapter 13 bankruptcy filings. At the Law Offices of Neil Crane, we’ve been Harford foreclosure attorneys since 1983. The secret to our success is how much we know: We’ve done over 15,000 successful cases in CT and thousands in the Hartford area

And how well we do it: We’re a team of five long-term lawyers and seven long-term support staff entirely committed to your success.

To learn more about saving your home, contact the most successful Foreclosure Lawyer Hartford, CT and across the state at the Law Offices of Neil Crane. Attorney Neil Crane will take your call and walk you through your options for saving your home. We answer every call, we never use voicemail.

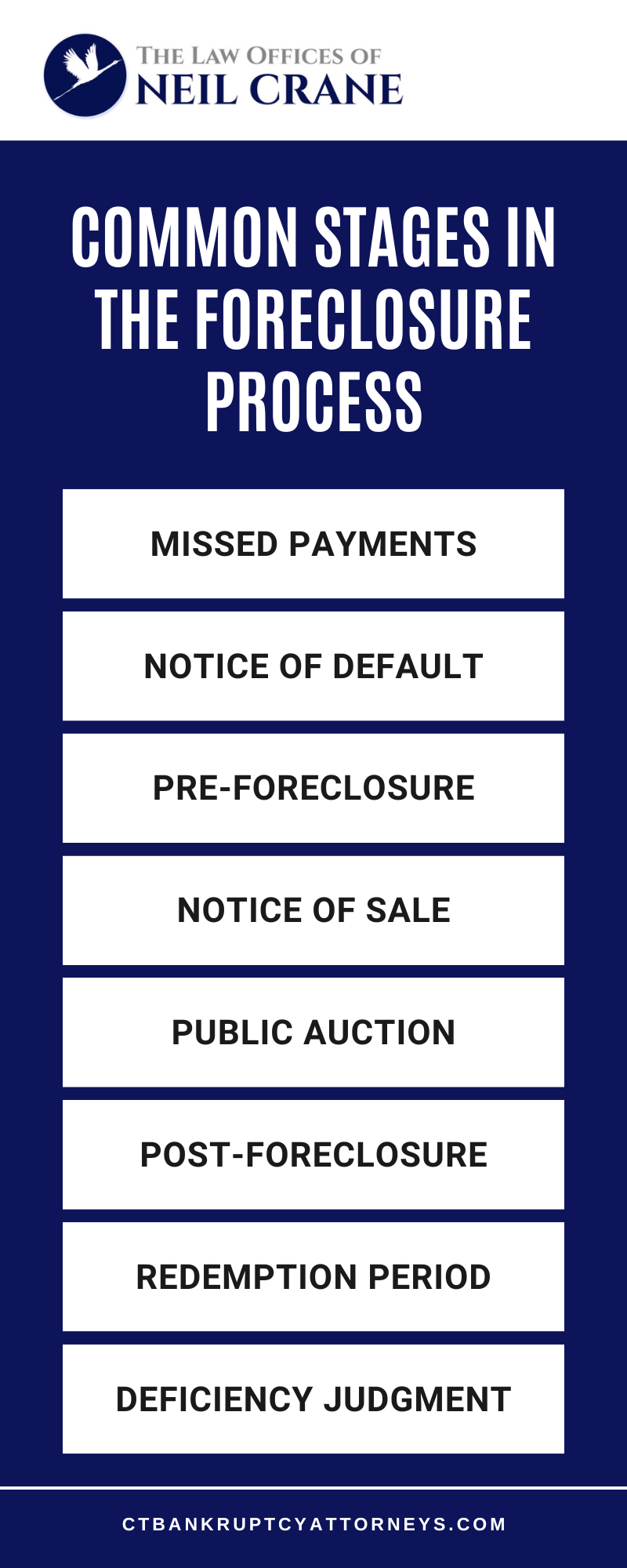

Understanding The Stages In The Foreclosure Process

As our Hartford, CT foreclosure lawyer will share, it’s important to have a clear understanding of the stages involved with the foreclosure process, especially to ensure that you feel more in control over the situation. At The Law Offices of Neil Crane, we believe that informed clients are empowered clients. Here’s a comprehensive guide to the stages in the foreclosure process, designed to clarify each step and what you can expect. Our team is here to provide support and guidance through every stage of this challenging process.

1. Missed Payments

The foreclosure process typically begins with missed mortgage payments. Once a homeowner fails to make a payment, the loan is considered delinquent. Lenders often give a grace period, but persistent non-payment can lead to more serious actions. It’s crucial to address any financial difficulties as soon as possible and communicate with your lender to explore potential solutions.

2. Notice Of Default

If missed payments continue, the lender will issue a Notice of Default (NOD). This formal document is typically sent after 90 days of missed payments and serves as a warning that the lender intends to take legal action. The NOD will specify the amount owed and provide a timeframe for the homeowner to rectify the situation, often referred to as the reinstatement period. During this time, it’s essential to seek advice from a legal professional to understand your options and rights.

3. Pre-Foreclosure

Following the Notice of Default, the property enters pre-foreclosure. This stage lasts for about three months and gives homeowners an opportunity to resolve the debt before the property is officially foreclosed. Options during this period include negotiating with the lender, refinancing the mortgage, or selling the property. Proactive measures can prevent the foreclosure from moving forward and minimize long-term damage to your credit.

4. Notice Of Sale

The lender will issue a Notice of Sale in situations where the homeowner cannot resolve the default during the pre-foreclosure period. This notice indicates that the property will be sold at a public auction. The notice is typically posted on the property and published in local newspapers to inform the public of the impending sale. This stage can be particularly stressful, and having a Hartford foreclosure lawyer by your side can help you navigate the complexities and explore any remaining alternatives.

5. Public Auction

The public auction is where the property is sold to the highest bidder. The auction’s date, time, and location are specified in the Notice of Sale. At the auction, the starting bid is usually set at the outstanding loan balance plus any additional fees incurred by the lender. If the property doesn’t sell at auction, it becomes a real estate owned (REO) property, and the lender takes possession.

6. Post-Foreclosure

After the auction, the new owner of the property (whether it’s the lender or a third party) must obtain possession. If the homeowner is still residing in the property, they will receive an eviction notice. The timeframe for vacating the property can vary, but it’s typically within 30 days. Post-foreclosure can be an incredibly challenging time, and seeking legal advice is critical to understanding your rights and obligations.

7. Redemption Period

In some states, homeowners have a redemption period after the foreclosure sale, allowing them to reclaim their property by paying the sale price, plus additional costs. While Connecticut does not have a statutory right of redemption, understanding this concept is essential for those dealing with foreclosure in different jurisdictions.

8. Deficiency Judgment

If the auction sale does not cover the total amount owed on the mortgage, the lender may seek a deficiency judgment against the homeowner. This judgment makes the homeowner responsible for the difference. Consulting with a lawyer can help you understand potential liabilities and defense strategies if faced with a deficiency judgment.

Hartford Foreclosure Infographic

Taking Action Against Foreclosure

To alleviate some of the stress and uncertainty associated with the foreclosure process, it’s important to have a clear understanding of the legal aspects involved. Each stage presents opportunities to address the issue and possibly prevent foreclosure. If you find yourself facing foreclosure, remember that you are not alone. Our team is dedicated to helping you through this difficult time. Our experienced Hartford foreclosure lawyers are here to provide the guidance and support you need.

Don’t wait until it’s too late, our firm has been offering bankruptcy and debt relief services since 1983. For services that include bankruptcy relief, foreclosure, small business bankruptcy, credit card debt relief, and tax debt resolution, contact us today for a consultation and take the first step toward protecting your future.

Hartford Foreclosure FAQs

Facing a foreclosure can feel overwhelming, but our Hartford, CT foreclosure lawyer can help you explore your options and take action to protect your home. Below, we address common questions homeowners in Connecticut often have regarding foreclosures.

What Should I Do If I Receive A Foreclosure Notice?

Upon receiving a foreclosure notice, it’s essential to act promptly, as ignoring the notice can lead to losing your home. Contact our Hartford foreclosure lawyers immediately to discuss your legal options so we can help you address the situation. Our team can assess your financial circumstances and discuss potential solutions, such as loan modifications or bankruptcy filings, to help you retain your property.

How Long Does The Foreclosure Process Take In Connecticut?

The foreclosure process in Connecticut varies but typically spans several months. Connecticut is a judicial foreclosure state, meaning the process involves court proceedings. After missing multiple mortgage payments, the lender will initiate legal action, which can lead to foreclosure if not addressed. Engaging with our foreclosure defense lawyer early on can provide more opportunities to explore alternatives and potentially extend the timeline to find a resolution.

Will I Owe Money After A Foreclosure?

Yes, in many cases, homeowners may still owe money after a foreclosure. This remaining debt, known as a deficiency judgment, includes the difference between the loan balance and the foreclosure sale price, along with additional costs like interest and fees. Connecticut allows lenders to pursue deficiency judgments, which can have long-term financial implications. Our mortgage defense attorneys can help you understand these consequences and explore strategies to mitigate or eliminate this remaining debt.

Can Bankruptcy Stop Foreclosure?

Yes, filing for bankruptcy can halt the foreclosure process. When you file for bankruptcy, an automatic stay is enacted, temporarily stopping all collection activities, including foreclosure. Chapter 13 bankruptcy, in particular, allows homeowners to reorganize their debts and create a repayment plan to catch up on missed mortgage payments, potentially saving their home. Our foreclosure prevention lawyers can evaluate your situation to determine if bankruptcy is a suitable option for you.

Are There Alternatives To Foreclosure?

Yes, there are several alternatives to foreclosure, including:

- Loan Modification: Adjusting the terms of your mortgage to make payments more manageable.

- Short Sale: Selling your home for less than the outstanding mortgage balance with the lender’s approval.

- Deed in Lieu of Foreclosure: Voluntarily transferring the property title to the lender to satisfy the debt.

- Foreclosure Mediation: Participating in a court-sanctioned program to negotiate with your lender.

Each option has its pros and cons, and the best choice depends on your specific circumstances. Consulting with our Hartford foreclosure attorneys can help you determine the most appropriate course of action.

Foreclosure Glossary

If you’re looking for help from a Hartford, CT foreclosure lawyer, this glossary provides essential terms to better understand the legal processes that can affect your home. These definitions are based on real situations many Hartford-area homeowners face, and knowing what they mean can help you make better decisions about your options. This information is especially useful when considering legal assistance to protect your home from foreclosure.

Notice Of Default

A Notice of Default (NOD) is a formal letter from a mortgage lender sent after a homeowner has missed several mortgage payments—typically 90 days or more. It signals the beginning of the foreclosure process. The NOD notifies the borrower that they are in breach of their mortgage agreement and gives a deadline to pay the past-due balance to prevent further legal action. In Hartford, this is a critical point at which legal intervention may allow homeowners to negotiate terms, pursue alternatives, or initiate legal defenses that can halt or delay the foreclosure.

Foreclosure Mediation

Foreclosure mediation is a legal process available in Connecticut that allows homeowners and lenders to meet in a court-supervised setting to discuss potential resolutions to avoid foreclosure. While this option is available to most homeowners, participation without legal representation often leads to poor outcomes. Bank attorneys and court mediators are not required to work in the homeowner’s interest. When used properly with legal representation, foreclosure mediation can create the opportunity for loan modification or other agreements that allow the homeowner to keep the property.

Forbearance Agreement

A forbearance agreement is a temporary arrangement between a lender and a borrower that pauses or reduces mortgage payments for a limited time. During this pause, no foreclosure action is taken. However, once the forbearance ends, all skipped payments become due, often placing homeowners in an even more difficult financial position. This type of agreement does not erase the debt—it only delays payment. Legal advice is often needed to transition from forbearance to a more stable, long-term solution such as a modification or a structured repayment plan.

Mortgage Modification

A mortgage modification is a permanent change to one or more of the terms of a loan to make monthly payments more manageable. Modifications often involve reducing the interest rate, extending the loan term, or rolling missed payments into the loan balance. To be approved, homeowners must submit a detailed application including proof of income and a written hardship explanation. Lenders frequently delay or deny applications without clear reasons. Legal assistance can be essential to presenting a complete and timely modification request and to prevent unnecessary foreclosure proceedings during the review process.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is a federal legal process that allows homeowners to stop foreclosure and create a payment plan to catch up on missed mortgage payments over three to five years. It protects the homeowner from collection efforts immediately upon filing through what’s called an “automatic stay.” Unlike other foreclosure alternatives, Chapter 13 does not require lender consent. The plan is confirmed by the bankruptcy court and gives the homeowner the chance to stay in the home while addressing other unsecured debts like credit cards and medical bills. It is one of the most powerful tools for saving homes in Connecticut.

Homeowners facing foreclosure in Hartford, CT have options. Legal tools like foreclosure mediation, mortgage modifications, and Chapter 13 bankruptcy can help stop foreclosure and provide a path toward keeping your home. At Culpepper Law Group, we are committed to providing clear legal advice backed by experience.

If you’re dealing with missed mortgage payments or received a foreclosure notice, call now. We’re ready to help you take the next step toward keeping your home.

Take Action Today

If you’re facing a foreclosure, it’s vital to seek professional legal assistance promptly. At The Law Offices of Neil Crane, we’ve been providing debt relief solutions since 1983, helping countless Connecticut residents work through financial challenges such as foreclosures. Our experienced attorneys are committed to finding the best solution for your unique situation. Contact us today to schedule a free consultation and take the first step toward securing your financial future.