Everyone wants to be able to make their tax payments on time, but sometimes financial hardships and other life factors can make this difficult to do. For some, it has become impossible to deal with their mounting tax debts. Our experienced Danbury, CT tax lawyer can help you achieve the tax relief you are looking for, so that you no longer carry the burden of these debts on a daily basis. It can be immensely freeing to find solutions that bring ease. Please don’t hesitate to speak with our team at The Law Offices of Neil Crane for individualized support. There may be solutions that you didn’t realize are available to do. To learn more, contact us as soon as you can.

Skilled Tax Law Help

If you are having a hard time keeping up with your personal or small business taxes, have gotten a notice from the IRS, or are currently undergoing an audit, there is a good chance that a skilled Danbury, CT tax lawyer can help. If you need tax help with taxes, credit card consolidation, credit card or other debt relief, debt consolidation, and bankruptcy, The Law Offices of Neil Crane have been successfully helping clients with these and similar issues since 1983. Tax experts, CPAs, tax firms, accountants, and other tax professionals regularly seek our advice and refer their most difficult cases to us. In addition to our skills and success, we understand the stress that tax issues cause and we do not want you to feel any embarrassment or shame for being in the situation you are in. We have 24/7 live answering and offer free, no-obligation consultations. Contact us today to see how we can help alleviate at least some of your stress.

Tax Law

On the surface and to a layperson, tax law often appears to be a complicated maze of regulations with new twists and turns every year. While in many ways this is true, a good lawyer with knowledge and skills in this area can help to secure your or your business’s financial future. State taxes in Connecticut are governed by the Connecticut State Department of Revenue and federal taxes are governed by the Internal Revenue Service. A good Danbury, CT tax lawyer should be able to help you with both state and federal taxes and tax issues.

What Tax Lawyers Do

In a nutshell, tax lawyers help their clients with tax planning and compliance, IRS representation, and tax dispute resolution, and provide specialized advice for complex tax matters. Tax planning involves crafting tax-efficient strategies for individuals and businesses. Tax compliance is a process to ensure adherence to tax laws. A tax lawyer can defend and represent clients in IRS audits and disputes. In disputes, they try to negotiate settlements and reduce liabilities with tax lawyers.

When To Contact A Tax Compliance Lawyer

For many people, unless you already have a good tax law lawyer you can trust, now is a good time to call one. While a skilled tax lawyer can help people with many of their tax issues, even ones relating to the IRS, it is far less stressful to prevent tax issues before they become a big problem than dealing with them when they are one. Many people and small business owners think that they are in compliance with their taxes and they are not. These people are typically shocked that the government does not forgive those who are not in compliance for ignorance, no matter how innocent their intentions were.

Whether you are in over your head with tax issues or want to make sure that you don’t get there, The Law Offices of Neil Crane are here to help. Contact our highly skilled, experienced, and successful Danbury tax lawyer team any time of the day or night, any day of the year for a free consultation.

Tax Debt Bankruptcy

There are several possible solutions to your tax debt. After consulting with you further, we may suggest filing for bankruptcy. Through Chapter 7 and Chapter 13, you can halt tax penalties and interest right away. If you file for Chapter 7 bankruptcy, you will receive an immediate stay and have qualifying tax debts discharged. Through Chapter 13 bankruptcy, you can establish a reorganization of your debts through committing to a 3-5 year payment plan. The IRS offers a 6-month plan, but having a longer span of time can offer you more ease and less pressure.

Discharging Unpaid Taxes

The U.S. Bankruptcy Code allows a discharge of certain back taxes, but there are conditions that apply. Firstly, the taxes must be categorized as personal income tax. In general, most business taxes are not eligible for discharge. Whether a business can have their back taxes eradicated depends on the classification they fall under, such as payroll or sales taxes. Secondly, the taxes have to be at least 3 years old. Taxes that have accumulated sooner than that may not be dischargeable. Furthermore, there must be no evidence of taxpayer misconduct. Someone’s individual taxes may not get discharged through bankruptcy if the back taxes were from misconduct, like filing a tax return that was fraudulent or failing to file altogether. If the IRS has sent you a certified letter saying that you owe taxes, you must respond within 30 days.

Do not ignore any letters from the IRS regarding back tax debt. Reach out to our knowledgeable tax attorney about what to do next.

Your Tax Debt Solutions

Knowing that you have tax debts can be stressful, as no one wants to be in debt to the government. The IRS tends to be viewed as an intimidating presence that won’t relent in seeking unpaid tax debt from individuals and businesses. If you are facing an issue regarding past debts or want to learn more about possible solutions, then speak with our Danbury tax attorney at your earliest convenience. The team at The Law Offices of Neil Crane have helped so many people in a similar predicament as you, who just want to get rid of debts so they can have more peace of mind. Do not hesitate to contact us today for assistance.

Managing A Tax Audit With Help From A Danbury Tax Lawyer

Dealing with tax audits can be daunting for individuals and businesses alike, and professionals from The Law Offices of Neil Crane are here to help. Facing a tax audit requires a clear understanding of the legal implications and the proper steps to protect your rights and interests. In this article, we’ll explore key legal topics surrounding tax audits, providing essential information for anyone facing this challenging situation. Our aim is to make the complexities of tax law more approachable, especially for those seeking experience from a Danbury, CT tax lawyer. We are passionate about helping our clients and have been effectively and actively lobbying for borrowers’ rights before Congress since 1983.

Understanding Tax Audits

Tax audits are reviews conducted by tax authorities, such as the Internal Revenue Service (IRS), to verify the accuracy of a taxpayer’s returns and payments. The audit process can be triggered by various factors, including random selection, discrepancies in tax returns, or suspicious activities. It’s crucial to comprehend the legal grounds and procedures involved in tax audits to better prepare and respond effectively.

Types Of Tax Audits

There are several types of tax audits, each with different procedures and implications.

- Correspondence Audit: This is the most common type, conducted via mail. The IRS requests additional documentation or clarification regarding specific items on a tax return.

- Office Audit: This type requires the taxpayer to visit an IRS office to provide records and answer questions. It usually focuses on specific issues.

- Field Audit: Here, an IRS agent visits the taxpayer’s home or business to review records. This is the most comprehensive and intrusive type of audit.

When preparing the appropriate documentation and responses is incredibly helpful for understanding the type of audit you are facing.

Legal Rights During A Tax Audit

Taxpayers have specific rights during an audit to protect them from unfair treatment and ensure due process. These rights include:

- Right to Representation: Taxpayers can be represented by a qualified individual, such as a Danbury tax lawyer during an audit. This representation ensures that your interests are properly defended.

- Right to Privacy and Confidentiality: The IRS must respect your privacy and keep your information confidential throughout the audit process.

- Right to Appeal: If you disagree with the audit findings, you have the right to appeal the decision within the IRS or in court.

Being aware of these rights is essential for navigating an audit successfully.

Responding To A Tax Audit

Timely and accurate responses are crucial when dealing with a tax audit. It’s important to:

- Provide Complete Information: Ensure all requested documents and information are accurate and comprehensive.

- Communicate Effectively: Maintain clear and open communication with the IRS to avoid misunderstandings.

- Seek Professional Help: Engaging a lawyer can provide invaluable assistance in managing the audit process and defending your rights.

Consequences Of Tax Audits

The outcome of a tax audit can lead to various consequences, including:

- No Change: The IRS accepts the return as filed.

- Agreed: The taxpayer agrees with the proposed changes, which may result in additional taxes owed.

- Disagreed: The taxpayer disagrees with the findings, leading to potential appeals or litigation.

Understanding these potential outcomes helps in preparing for and responding to audit results effectively.

Effective Strategies For Facing Tax Audits

A clear understanding of your legal rights and obligations is crucial, and involves careful preparation when facing tax audits. At The Law Offices of Neil Crane, we are dedicated to helping you manage this complex process. We have had over 15,000 successful cases and our experience as a Danbury tax lawyer ensures that your interests are protected and that you are fully supported throughout the audit process. If you are facing a tax audit or need legal assistance, contact our Danbury tax lawyer today to schedule a consultation and safeguard your financial future.

How To Reduce Your Tax Burden

When facing tax obligations, enlisting the assistance of our Danbury, CT tax lawyer can be instrumental in reducing your tax burden. At The Law Offices of Neil Crane, we’ve been providing solutions and guidance regarding debt since 1983 and have successfully handled over 15,000 cases. Whether you’re dealing with IRS issues, tax debt, or general tax planning, professional legal support can make all the difference. Here are five ways our tax law professionals can help you achieve financial relief.

Strategic Tax Planning

Proactive tax planning is key to minimizing liabilities and maximizing savings. Many individuals and businesses end up paying more than necessary simply because they don’t have a solid tax strategy in place. Our tax resolution lawyers analyze your financial situation to identify opportunities for deductions, credits, and tax-saving strategies. By developing a customized plan, we help you retain more of your hard-earned income while ensuring compliance with federal and state tax laws.

Proper tax planning isn’t just about reducing your tax bill for the current year—it also sets you up for long-term financial stability. Whether you’re a small business owner, an independent contractor, or an employee, having our tax lawyers review your financials can lead to significant savings over time.

Representation During IRS Audits

Few things are more stressful than receiving a letter from the IRS about an audit. Audits can happen for various reasons, including discrepancies in reported income, excessive deductions, or random selection. Our IRS lawyers provide professional representation to make sure that the audit process is handled as smoothly as possible.

We work closely with you to gather necessary documentation, respond to IRS inquiries, and resolve any discrepancies. If necessary, we can also negotiate settlements or payment arrangements on your behalf.

Negotiating Tax Debt Settlements

If you’re burdened with significant tax debt, know that there are options available to help you regain financial control. Our Danbury tax lawyers negotiate with the IRS to explore solutions such as Offers in Compromise, installment agreements, or penalty abatements.

An Offer in Compromise allows you to settle your tax debt for less than the total amount owed, provided you meet the IRS’s strict eligibility requirements. Installment agreements, on the other hand, allow you to pay off your debt in manageable monthly payments. Our goal is to find the best possible solution based on your financial situation, helping you avoid unnecessary financial strain.

Addressing Unfiled Tax Returns

Unfiled tax returns can lead to substantial penalties, loss of refunds, and even legal action. The longer tax returns go unfiled, the more complicated the situation becomes. We assist in preparing and filing delinquent returns, working to minimize penalties and bring you back into compliance with tax authorities.

In many cases, filing late tax returns can help you avoid further penalties and may even qualify you for certain relief programs. If you’ve avoided filing due to financial hardship, we can help you explore options that prevent excessive penalties and interest from accumulating.

Legal Defense Against Tax Litigation

In some cases, tax disputes escalate to legal action, requiring strong defense strategies. We are prepared to represent you in tax litigation cases involving the IRS or state tax authorities. Whether it’s a contested audit result, disputes over tax liabilities, or allegations of tax fraud, we develop legal strategies aimed at achieving the best possible outcomes for our clients. We work diligently to present a strong case, negotiate settlements where applicable, and fight for favorable resolutions in court.

Take Control Of Your Tax Situation

At The Law Offices of Neil Crane, we’re committed to assisting individuals and businesses in Danbury and throughout Connecticut with effective tax solutions. Our team works tirelessly to help our clients reduce their tax burdens, resolve disputes, and avoid unnecessary financial strain. If you’re struggling with tax debt, facing an audit, or need guidance on tax planning, our Danbury tax lawyers are here to help. Contact us today to schedule a consultation and take the first step toward a more secure financial future.

Tax Law FAQs

Tax issues can be stressful and difficult to handle alone. Whether you’re dealing with IRS notices, unpaid taxes, or wage garnishments, having our Danbury, CT tax lawyer offer guidance can make a difference. At The Law Offices of Neil Crane, we have successfully handled over 15,000 cases, helping individuals and businesses find solutions to their tax concerns. Our founding attorney, Nick Crane, is widely known in the bankruptcy legal field and has been featured by the BBC and The New York Times for his work. Below, we answer common questions about tax-related legal issues.

When Should I Contact Our Lawyers About My Taxes?

If you owe back taxes, are being audited, or have received collection notices from the IRS, it’s a good time to seek legal help. The IRS has the authority to collect unpaid taxes through liens, wage garnishments, and bank levies. The sooner we address the issue, the more options we have to resolve it. We work with clients to prevent IRS actions or reduce their impact whenever possible.

Can I Lower My Tax Debt Through A Settlement?

In some cases, it is possible to settle tax debt for less than the full amount owed. The IRS offers programs such as an Offer in Compromise, which allows qualifying taxpayers to negotiate a lower payment. There are also installment plans and penalty reductions that may be available. We evaluate each client’s financial situation and work to find the best path forward.

What Are The Consequences Of Ignoring IRS Notices?

Ignoring IRS notices can lead to serious financial consequences. The IRS can place liens on property, seize bank accounts, or garnish wages. If the debt remains unpaid, further legal action could follow. Responding quickly can help prevent these issues from escalating. We assist clients in addressing tax matters before they result in enforcement actions. If the IRS has already taken steps against you, we can work to stop further penalties.

Can Legal Action Stop Wage Garnishment Or Tax Liens?

Yes, there are legal options to reduce or stop IRS collection actions. Wage garnishments and tax liens can often be challenged, negotiated, or removed through proper legal channels. Depending on the situation, we may negotiate a settlement, set up a payment plan, or take other actions to protect income and assets. Acting quickly increases the chances of a favorable outcome.

How Do I Get Help With My Tax Problems?

Taking action early can prevent serious financial consequences. If you’re facing IRS debt, an audit, or other tax challenges, we’re here to help. Our team has extensive experience handling tax-related legal matters and finding practical solutions for clients. If you need a Danbury tax lawyer, contact us today to schedule a consultation. We will review your situation, explain your options, and help you move forward with confidence.

Let Us Help You

If you’re unsure about your next steps, don’t wait until the IRS takes action against you. The sooner you get legal advice from The Law Offices of Neil Crane, the more options you’ll have to resolve your tax issues effectively. Call our office or fill out our online contact form to set up a consultation. Let us help you find the best solution for your situation and get back on track financially.

Types Of Tax Cases We Handle

At The Law Offices of Neil Crane, we work with individuals and businesses facing a wide range of tax issues. With over 35 years of experience and more than 15,000 successful cases, our team focuses on practical legal strategies that address IRS problems, state tax issues, and financial stress related to tax debt. Every case is different, and our Danbury, CT tax lawyers tailor their approach to meet the specific needs of each client.

IRS Tax Debt Resolution

We assist clients who owe back taxes to the IRS and need a path forward. Our Danbury tax lawyers work to develop repayment plans, settle debt where possible, and stop enforcement actions like levies or garnishments.

State Tax Issues

State tax problems can be just as serious as federal ones. We help clients resolve unpaid Connecticut state income taxes, handle audits, and deal with enforcement actions by the Department of Revenue Services.

Tax Liens And Levies

When tax authorities file liens or initiate levies, it can threaten your income and property. We act quickly to negotiate release terms and prevent further harm to our clients’ finances and credit.

Payroll Tax Problems

Business owners who fall behind on payroll taxes face serious penalties. We represent employers who need to catch up on payments and resolve disputes without losing control of their business operations.

Audit Representation

Facing an audit can be stressful without support. Our Danbury tax lawyers represent clients during both IRS and state audits, helping them prepare documentation, respond to requests, and protect their rights throughout the process.

Offers In Compromise

For those who qualify, an Offer in Compromise can reduce the total amount owed to the IRS. We evaluate financial eligibility and prepare proposals that meet IRS standards.

Installment Agreements

Many taxpayers benefit from structured payment plans. We help clients set up reasonable monthly payments to resolve large balances over time, avoiding more aggressive collection efforts.

Tax Penalty Relief

Penalty charges can often be reduced or removed with the right request. We help clients present valid reasons for relief, including financial hardship or reasonable cause.

Business Tax Issues

Businesses dealing with sales tax, corporate tax filings, or classification issues come to us for reliable legal support. We guide owners through dispute resolution and long-term planning.

Tax Discharge In Bankruptcy

In some situations, tax debt can be discharged through bankruptcy. We review client history and timing to determine whether this is a viable option under current law.

Speak With Us

Working with our Danbury tax lawyers means having someone on your side who understands both the legal system and the real-world impact of tax debt. Our team at The Law Offices of Neil Crane is ready to assist with your situation. If you’re looking for a tax attorney in Danbury with decades of experience and a strong record of results, contact us today. Our team will review your situation, help you explore all available legal options, and guide you through each step with confidence and care.

6 Common Reasons People Run Into Tax Problems

At The Law Offices of Neil Crane, we’ve spent decades helping individuals and small business owners work through tax problems and find long-term solutions. Tax issues can impact anyone—no matter how much they earn or how carefully they try to stay organized. Over time, we’ve found that a few common causes come up more than others when people reach out to our Danbury, CT tax lawyers for help.

Whether someone is facing IRS pressure, dealing with missed filings, or caught in a situation that’s gotten out of control, these are some of the top reasons people end up needing guidance with tax matters.

1. Missed Or Late Tax Filings

One of the most frequent reasons people experience tax issues is failing to file on time. Sometimes a person forgets, misses the deadline due to personal events, or doesn’t realize they’re required to file. While one late return may not seem like a big issue, the problem can snowball over time. The IRS may assess penalties and interest, and failure to file several years in a row can lead to enforcement actions.

2. Underreporting Income

Another common situation we see involves individuals or business owners who unintentionally—or in some cases, knowingly—fail to report all their income. This often happens with freelance work, cash payments, or income from side businesses. The IRS matches reported income from various sources, and discrepancies can trigger audits or additional taxes due.

3. Payroll Tax Issues

Small business owners often come to us because of payroll tax problems. It’s not unusual for businesses to fall behind on payroll tax deposits during tough times, especially when trying to keep operations running. Unfortunately, the IRS takes payroll taxes seriously, and missing these payments can lead to serious consequences for both the business and its owners.

4. IRS Audits Or Notices

Many clients contact our Danbury tax lawyers after receiving a notice or audit letter from the IRS. These letters can be confusing and stressful. Whether it’s a simple question about a deduction or a full audit of multiple years, responding promptly and properly is important. Mistakes or delays can make the situation worse, even if the original issue was minor.

5. Self-Employment And Estimated Taxes

Self-employed individuals and contractors often face tax problems related to estimated payments. Unlike traditional employees, there’s no automatic withholding, so taxes must be paid manually throughout the year. Missing or miscalculating these payments can lead to large bills come tax season, plus penalties and interest.

6. Inability To Pay What’s Owed

Sometimes, people simply can’t afford to pay their tax bills. Job loss, medical expenses, or other financial setbacks can make it impossible to keep up. The IRS does offer options such as installment agreements or offers in compromise, but applying for relief involves the right legal strategy and paperwork. Many of our clients in this situation benefit from a detailed review of their finances and legal options.

Speak With Us

At The Law Offices of Neil Crane, we understand how overwhelming tax problems can feel. With over 35 years of experience, Attorney Neil Crane has helped thousands of individuals and families across Connecticut resolve tax debt and regain financial control. His work extends beyond taxes—he’s been a leader in Chapter 7, 11, and 13 bankruptcy relief and is especially committed to helping people keep their homes out of foreclosure. With over 15,000 cases handled, his knowledge is practical, focused, and always centered on long-term recovery.

If you’re struggling with back taxes or ongoing problems with the IRS or state, working with our Danbury tax lawyers can give you clarity and help you move forward. Our team works with individuals, families, and small businesses to address the root causes of tax issues and create realistic, legal solutions. Contact The Law Offices of Neil Crane to take the next step. We’re ready to help you get a handle on your tax situation and protect your financial future—whether it’s your first problem or a long-standing concern. Let’s talk about how we can help.

Danbury Tax Infographic

Danbury Tax Statistics

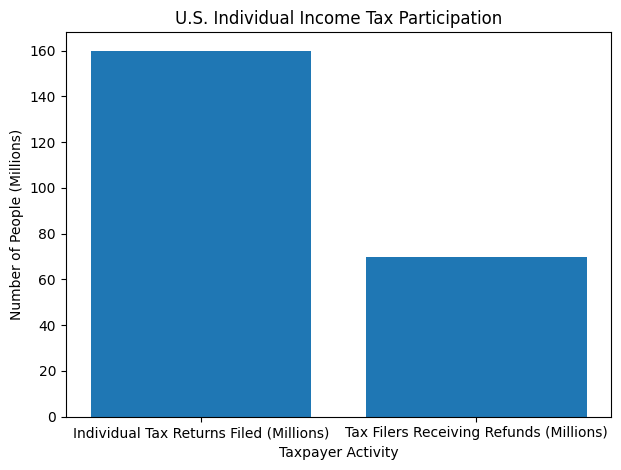

Income tax statistics show how widespread income tax participation is and how central it is to government funding. According to data published by the Internal Revenue Service (IRS), more than 160 million individual income tax returns are filed annually in the United States, reflecting that the vast majority of working adults are part of the federal income tax system. Of those filers, tens of millions receive refunds, which occur when more tax is withheld during the year than is ultimately owed.

IRS data also show that individual income taxes account for over 50 percent of total federal revenue, making them the single largest source of funding for the federal government. Payroll taxes for Social Security and Medicare represent the next largest category, while corporate income taxes make up a much smaller share of overall receipts.

Danbury Tax FAQs

Tax issues can affect both individuals and businesses, often creating stress and uncertainty about the future. Whether you are dealing with unpaid taxes, IRS notices, unfiled returns, or state tax matters, getting the right legal guidance can make a difference in the outcome. With over 35 years of experience and more than 15,000 successful cases, we have the knowledge and practical experience to address a wide range of tax problems. Our Danbury, CT tax lawyer team works closely with clients to fully understand their circumstances, explain their options in plain language, and create a plan aimed at resolving issues efficiently. Below are some common questions we hear from clients and our straightforward answers, based on years of helping people in situations just like yours.

How Can A Tax Attorney Help Me With Back Taxes?

We assist clients in resolving unpaid tax balances through structured payment plans, negotiations, or other legal solutions. Back taxes can result in liens, wage garnishments, or other enforcement actions. Our goal is to address the matter quickly and protect your financial stability.

What Should I Do If I Receive A Notice From The IRS?

It’s important to carefully review any IRS notice and respond within the given timeframe. We meet with you to explain what the notice means and develop a plan of action. Taking timely steps can prevent additional penalties and help control the situation before it escalates.

Can A Tax Lawyer Help Reduce Penalties And Interest On Tax Debt?

In many cases, yes. We may be able to request penalty abatement or negotiate for reduced interest when certain conditions are met. We gather the necessary information, prepare formal requests, and communicate with the IRS or state tax authorities to present your case effectively.

What If I Have Unfiled Tax Returns For Several Years?

Our Danbury tax lawyers assist clients in filing past-due returns to prevent further legal or financial consequences. Leaving returns unfiled can lead to enforcement actions, so addressing them promptly is important. We help collect the required documents, prepare the filings accurately, and represent you in discussions with tax agencies.

Can A Tax Attorney Handle State Tax Issues As Well As Federal Ones?

Yes. We represent clients in both Connecticut state and federal tax matters, including audits, assessments, tax lien releases, and payment arrangements. We work to address your situation from every legal angle to find a solution that works for you.

Tax Law Glossary

For anyone seeking support from a Danbury, CT tax lawyer, understanding the language of tax law can be the first step toward better control of your financial situation. This glossary provides clear, practical definitions for terms that frequently arise in tax cases handled by our firm. Whether you’re dealing with the IRS, overdue tax filings, or long-standing debt, these terms reflect real legal tools and procedures available to individuals and small businesses alike.

We’ve chosen five specific terms that relate to federal and Connecticut state tax issues. Each entry below includes a detailed explanation that reflects how the concept functions in everyday legal matters.

IRS Audit

An IRS audit is a formal review by the Internal Revenue Service to verify the accuracy of a taxpayer’s filings. Audits are triggered by factors like unreported income, unusually high deductions, or patterns that deviate from statistical norms. The IRS may initiate a correspondence audit through the mail, request an in-person meeting at an office, or conduct a field audit at your home or business.

The audit process requires accurate documentation and clear communication. If you disagree with the audit findings, you have a right to appeal. While the idea of an audit often causes anxiety, it is essentially an investigative process that seeks to verify facts. Representation by a tax lawyer can help make the process more manageable, especially if financial penalties are proposed.

Offer In Compromise

An Offer in Compromise (OIC) is a program administered by the IRS that allows taxpayers to settle outstanding tax debt for less than the full amount owed. It is only granted when the IRS believes that collecting the full amount is unlikely or would cause severe financial hardship. To qualify, the taxpayer must submit a detailed financial disclosure and meet specific legal criteria.

The IRS considers factors like income, expenses, asset equity, and future earning potential. OICs are not automatically accepted, and the process is paperwork-heavy and highly scrutinized. However, for qualifying individuals, it can provide a fresh start and eliminate debt that has been building for years. We regularly assist clients with preparing and submitting Offers in Compromise that meet IRS standards.

Installment Agreement

An installment agreement is a structured payment plan approved by the IRS or state tax authority, allowing taxpayers to pay off their debt over time. These agreements can vary in length and terms depending on the amount owed and the taxpayer’s financial situation. For many, this option helps avoid immediate collections like wage garnishments or bank levies.

Taxpayers must remain current with future tax filings and payments while under an agreement. If they default, the agreement can be revoked, and enforcement may resume. A lawyer can help negotiate monthly terms that fit within your budget and file the required forms to get the process started.

Tax Lien

A tax lien is a legal claim made by the government against a person’s property when taxes are not paid. It protects the government’s interest in the taxpayer’s assets, including real estate, vehicles, and financial accounts. A lien can affect credit scores, limit the ability to sell property, and deter lenders from offering financing.

Once placed, a lien remains until the debt is paid or legally removed. Taxpayers can request a lien release, withdrawal, or subordination depending on their circumstances. Early legal action can help prevent a lien or negotiate a release after compliance is achieved. Our firm works with clients to remove liens and repair the financial damage they can cause.

Tax Discharge In Bankruptcy

Tax discharge in bankruptcy refers to the elimination of certain tax debts through a Chapter 7 or Chapter 13 filing. Not all taxes qualify for discharge. Generally, income taxes that are at least three years old and were filed properly—without fraud—may be discharged. Business taxes, including payroll and sales tax, are typically not dischargeable.

Chapter 7 may erase qualifying tax debts entirely, while Chapter 13 allows for a repayment plan over several years. Both options offer a stay of enforcement, halting garnishments and interest during the case. The process requires careful review of IRS timelines and filing history. We evaluate each client’s eligibility based on the U.S. Bankruptcy Code and help decide if bankruptcy offers a viable tax relief path.

Our team at The Law Offices of Neil Crane has worked with clients across Connecticut for decades, offering steady legal support in tax matters ranging from audits to bankruptcy. If you are unsure about your options or facing pressure from the IRS or state tax authorities, we’re ready to help.

Let’s discuss your situation in confidence, contact us today to schedule a consultation and take the first step toward relief.

Let Us Help

At The Law Offices of Neil Crane, we understand that tax issues can be overwhelming, but they don’t have to be faced alone. We are committed to giving each client the attention and legal support they need to move forward. Whether your challenge involves IRS debt, state tax concerns, or long-overdue filings, our team is ready to step in with the resources and experience necessary to protect your rights. If you need our trusted Danbury tax lawyer to help with back taxes, IRS notices, or other tax concerns, contact us today to take the first step toward resolving your matter and building a more secure financial future.