Chapter 7 Bankruptcy Stratford CT

As the local economy in Stratford, CT attempts to regain itself following serious Pandemic upheaval, many Stratford, CT residents will need the advice and guidance of experienced Chapter 7 Bankruptcy counsel in Stratford, CT. Some of the hardest-working Stratford individuals and families have struggled during the Pandemic and needed to borrow from their credit cards and other high-interest consumer debt just to keep them going. Unfortunately, these too-high debt loads can prevent their post-pandemic recovery. They are stuck in a struggle to make payments on the overwhelming debt in the face of the rising costs of living in Fairfield County. Despite all the steps they take to stay alive and continue to pay for life’s necessities, they now find themselves with a financial hangover that threatens their ability to support themselves and their families. If you’re a Stratford resident having trouble making ends meet, you’re not alone. Thousands of other Stratford residents struggle silently with the same scary financial problems you face every day. At the Law Offices of Neil Crane, our Chapter 7 bankruptcy attorneys understand all the pressures and silent suffering caused by overwhelming debt coupled with the ever-rising cost of living in Stratford, CT.

As the local economy in Stratford, CT attempts to regain itself following serious Pandemic upheaval, many Stratford, CT residents will need the advice and guidance of experienced Chapter 7 Bankruptcy counsel in Stratford, CT. Some of the hardest-working Stratford individuals and families have struggled during the Pandemic and needed to borrow from their credit cards and other high-interest consumer debt just to keep them going. Unfortunately, these too-high debt loads can prevent their post-pandemic recovery. They are stuck in a struggle to make payments on the overwhelming debt in the face of the rising costs of living in Fairfield County. Despite all the steps they take to stay alive and continue to pay for life’s necessities, they now find themselves with a financial hangover that threatens their ability to support themselves and their families. If you’re a Stratford resident having trouble making ends meet, you’re not alone. Thousands of other Stratford residents struggle silently with the same scary financial problems you face every day. At the Law Offices of Neil Crane, our Chapter 7 bankruptcy attorneys understand all the pressures and silent suffering caused by overwhelming debt coupled with the ever-rising cost of living in Stratford, CT.

Making a first call for help is the most difficult but important step to regaining your finances. Stratford residents have a history of hard work and proud privacy. They worry endlessly about making ends meet, but they don’t speak about it to their friends or their neighbors, or even their relatives. Stratford families all struggle with the same problem in secret silence, not realizing that thousands of their Stratford friends and neighbors feel crushed under the exact same economic perils that keep them up at night. More importantly, they also don’t know that they have legal protections that can assure straight steps to a renewed financial future. They don’t know that all their shared fears have professional and legal answers. There are strong laws written just for them – Laws specifically enacted to solve their financial problems and get them promptly on the road to the recovery they so desperately want and need.

At some point, you just can’t do it on your own – you need answers and options and help. Fortunately, there are strong, powerful Chapter 7 federal protections enacted by federal law generations ago exactly to address the same concerns and problems you face today. Great solutions exist, you just need to ask. The Federal Bankruptcy Law under Chapter 7 is a Borrower’s Bill of Rights for you and your recovery. At the Law Offices of Neil Crane, we’ve been providing Chapter 7 bankruptcy answers and individual relief to Stratford, CT residents since 1983. You just need to make that first call, that initial contact and we’ll open a new world of solutions and options you may never know existed. You have rights, we know them, and how to get you on the fast road to a full recovery.

It just takes a call to our office. Attorney Neil Crane knows how hard that call may be. He also knows that he can help anyone who calls by welcoming them to a world of options and solutions proven over a four-decade career helping Stratford individuals and families just like yours. Knowing the solutions and how hard it is to call, Attorney Neil Crane takes all calls directly. He can reveal a new world of life-changing solutions within moments of your first call or contact with our office. Call Attorney Neil Crane and get in contact with the most experienced Chapter 7 attorney in Connecticut.

Chapter 7 Eliminates Credit Card Debt

Chapter 7 is the most common form of bankruptcy filed for the protection of individuals, families, and homeowners in Stratford, CT. Its major focus and advantage is the complete elimination of all forms of unsecured debt. Under Chapter 7, all forms of general unsecured debt are “discharged” or eliminated in full. This is the perfect relief needed by Stratford residents in today’s economy, where credit card rates are outrageous and mortgages have never been so affordable. Unsecured general debt relief properly delivered by experienced and specialized Chapter 7 bankruptcy attorneys assures that more of your household income can be used for the more important household expenses that make Fairfield County budgets so challenging. By “discharging” unhealthy debt loads and unmanageable debt-to-income ratios, Chapter 7 frees your income for rent, mortgages, food, and other items essential to financial health. Chapter 7 Bankruptcy prevents monthly credit card payments from diverting large portions of monthly income to super high-interest payments.

Chapter 7 relief permanently terminates the every-month loss of money to credit card companies and high-interest “wasteful debt.” Since Chapter 7 bankruptcy is a permanent elimination of these wasteful payments, it results in an immediate end to the otherwise never-ending loss of wasted monthly payments as credit cards and consumer loan balances never seem to go down. At the Law Offices of Neil Crane, we’ve used Chapter 7 bankruptcy to help hundreds of Stratford, CT residents get off the Merry-go-Round nightmare of endless monthly credit card payments.

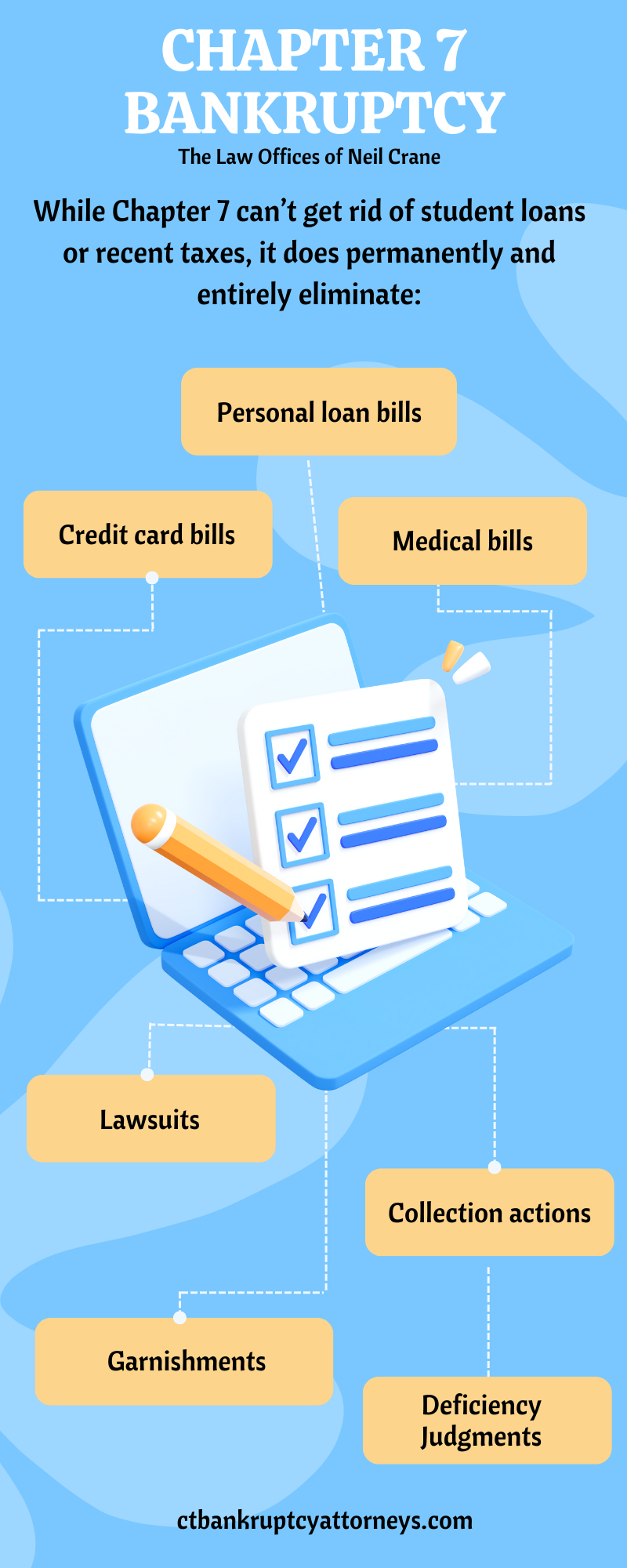

While Chapter 7 can’t get rid of student loans or recent taxes, it does permanently and entirely eliminate:

- Credit card bills

- Personal loan bills

- Medical bills

- Lawsuits

- Collection actions

- Garnishments

- Deficiency Judgments

- Repossessions

Stratford Chapter 7 Bankruptcy Infographic

All of these debts are extinguished immediately and permanently under Chapter 7 at any stage of collection. Chapter 7 even eliminates lawsuits and past judgments against you and your assets. Like all good bankruptcy work, the key to perfect Chapter 7 protection is specialized counsel, experience, knowledge, and perfect preparation of each case and every fresh start. At the Law Offices of Neil Crane, we’ve been eliminating credit card debt and improving lives as Stratford Chapter 7 lawyers for over 38 years. Give us a call to see how we can help you get back on track and achieve financial freedom.

Stratford Chapter 7 Bankruptcy Statistics

According to statistics released by the Administrative Office of the U.S. Courts, the annual bankruptcy filings in the calendar year 2021 totaled 413,616, compared with 544,463 cases in 2020, according to statistics released by the Administrative Office of the U.S. Courts.

Protection for You Under Chapter 7 Bankruptcy

The Chapter 7 bankruptcy system was created for individuals who need legal help when they just can’t solve it on their own. It’s powerful federal protection that stops creditors and preserves all that you own from aggressive creditors and lawsuits so that your belongings won’t be lost or levied. Numerous laws and Bankruptcy provisions under Chapter 7 make sure that no creditor can ever take what you own, like:

- Homes

- Bank accounts

- Cars

- Pension

- Retirement money

- Wages

- Worker’s Compensation Claim

- Household goods

- Many others

Chapter 7’s strong legal provisions make sure that unsecured debt never gets attached, lined, or secured on what you own, starting on the date you file Chapter 7 and continuing forever – permanently eliminating unsecured debt and threats to your hard-earned belongings.

Qualifying for Chapter 7 Bankruptcy Protection

While all individuals are allowed to apply for Chapter 7, they must qualify to be eligible for its relief and advantages. Qualifying for a Chapter 7 case requires the help and guidance of an experienced Chapter 7 bankruptcy attorney in Stratford, CT. Perfect legal preparation of Chapter 7 cases assures your eligibility and your right to all the protection and relief afforded to a properly filed Chapter 7 petition. At the Law Offices of Neil Crane, we are experts at qualifying Stratford residents for the full relief of Chapter 7 bankruptcy. Our experience and specialization assure that we know exactly how to prepare every Chapter 7 and assure it runs smoothly with guaranteed results well-known in advance of any Chapter 7 bankruptcy filing. In addition to perfect analysis and preparation, we understand all the nuances and trade secrets developed over almost 40 years of legal practice dedicated to Chapter 7 bankruptcy relief.

Income Qualification Under Chapter 7 at the Law Offices of Neil Crane

Under the latest version of the Bankruptcy Code, admission to Chapter 7 protection requires income qualification. Higher-income individuals and families need to meet specific guidelines for Stratford, CT residents to properly file under Chapter 7. While income qualification may be a complicated calculation for most lawyers, it’s clear and exact in our office as we’ve been qualifying Stratford residents for Chapter 7 relief since the income requirements began in 2005. We’ve dedicated over 15 years of our careers assuring maximum use of the Chapter 7 bankruptcy law and all its nuances. This enables us to offer the maximum amount of Chapter 7 coverage to the most amount of people and families possible. By knowing every written law and every unwritten rule, we’ve been able to provide the greatest Chapter 7 relief available under the law!

Median Income and Means Testing

Median income standards and Means Testing are essential elements of income qualification as determined by laws and rules both written and unwritten. Understanding the full scope of all the guidelines for income admission into Chapter 7 is the essence of our high-level Chapter 7 practice. Through experience and specialized knowledge, we’ve been able to provide our Stratford clients with the greatest amount of Chapter 7 income eligibility available under each person’s special and unique circumstances.

Median income numbers and Means Testing both operate off an income analysis of your income from all sources over the trailing six months, doubled to create a full-year analysis. All income counts, other than Social Security and Social Security Disability. Median Income and Means Testing all have special rules for calculating the family size. Both entryways into Chapter 7 income qualification involve complex calculations that we’ve used to succeed in qualifying over 5,000 individuals and families for full Chapter 7 relief.

The Law Offices of Neil Crane Chapter 7 Bankruptcy Stratford

Zip Codes We Serve: 06607, 06614, 06615 and 06673

To learn more about eligibility and the benefits of full debt relief under Chapter 7 bankruptcy in Stratford, CT, call the premier Chapter 7 Bankruptcy lawyers at the Law Offices of Neil Crane You can speak directly with Attorney Crane who will always take your call. It’s way too important for voice mail.