Bankruptcy Lawyer Stratford CT

Bankruptcy law is a specialized group of federal laws that provides legal protections for individuals with overwhelming money problems. As a bankruptcy lawyer Stratford, CT can count on, Attorney Neil Crane has full working knowledge of all the protections and rights granted to individuals and families seeking a financial fresh start. At the Law Offices of Neil Crane, we’ve dedicated our careers and all of the resources of our office to aggressively representing hardworking families seeking a better life. We’re the largest team of consumer bankruptcy lawyers in Connecticut. As Stratford, CT bankruptcy lawyers, we have the knowledge and experience to diagnose any financial mess and put together a prompt and comprehensive plan customized for your financial recovery.

Bankruptcy law is a specialized group of federal laws that provides legal protections for individuals with overwhelming money problems. As a bankruptcy lawyer Stratford, CT can count on, Attorney Neil Crane has full working knowledge of all the protections and rights granted to individuals and families seeking a financial fresh start. At the Law Offices of Neil Crane, we’ve dedicated our careers and all of the resources of our office to aggressively representing hardworking families seeking a better life. We’re the largest team of consumer bankruptcy lawyers in Connecticut. As Stratford, CT bankruptcy lawyers, we have the knowledge and experience to diagnose any financial mess and put together a prompt and comprehensive plan customized for your financial recovery.

All money problems feel personal and often frightening so you need to get smart and make that first frightening call. Attorney Neil Crane takes every call to our office. He knows how hard it is to call, how hard it is to admit you have a problem, and how much he can help. Never feel bad about financial problems, they can happen to the best, hardest working residents of Stratford, CT. We appreciate the opportunity to work on behalf of all our Stratford bankruptcy clients whose trust in us has been earned and respected for over 35 years.

Most Stratford residents struggle in private and don’t know that there are legal solutions to financial problems. Properly executed bankruptcy proceedings produce all the key elements for financial recovery:

- An immediate stop on all collection actions, phone calls, and lawsuits

- Immediate protection of all assets

- The resolution of all debt faced by individuals and small businesses

- Predictable certain results are known in advance in our office calculated to exact numbers with organized paperwork documentation

- A respectful process with no appearance in court, no contact with creditors, and one ten-minute meeting

The bankruptcy system is perfectly equipped with strong federal jurisdiction that overrides all courts at any stage of the court process. It assures that all Stratford, CT residents have the protection of the federal bankruptcy system and the right to protect their assets and achieve a financial fresh start.

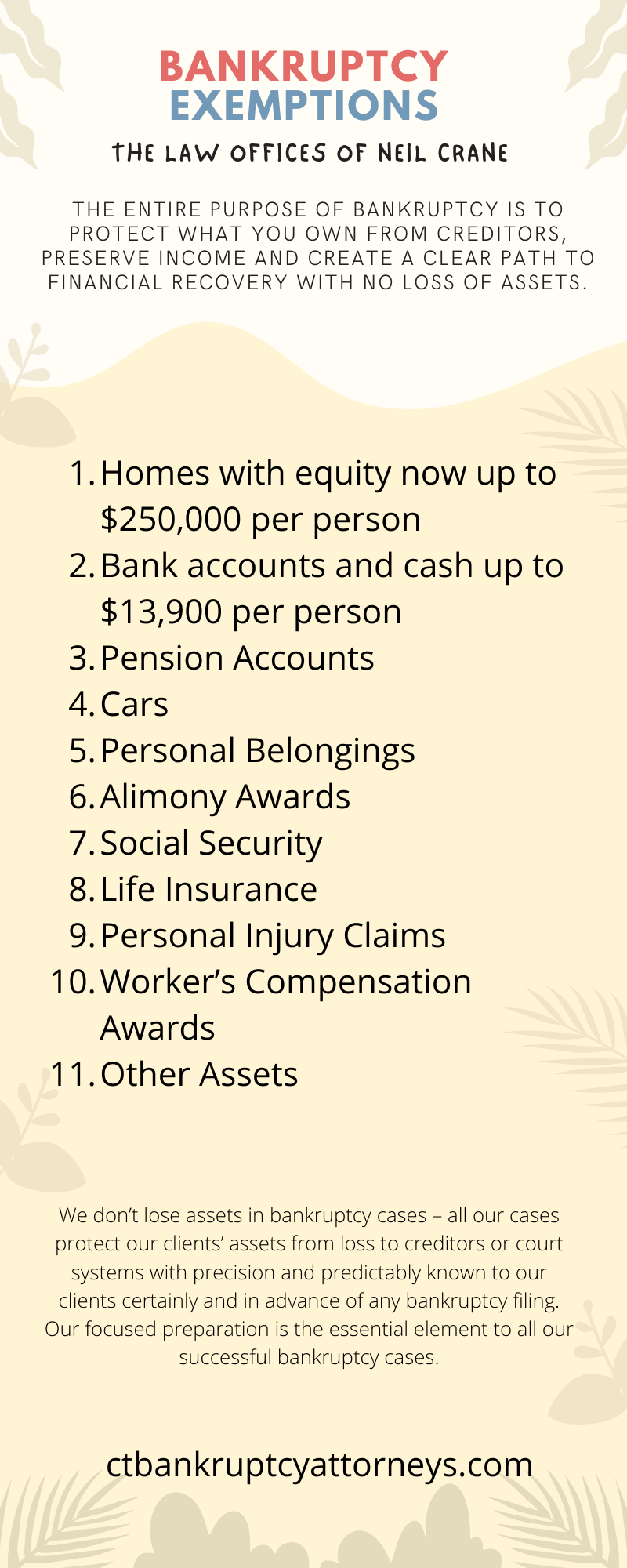

Asset Protection Under Bankruptcy Law in Stratford, CT

Contrary to all myths, bankruptcy law is specifically written for the protection of individuals’ assets; houses, personal belongings, cars and bank accounts, pensions, and lots of other federally protected “exempt assets.” These are deemed protected and under federal bankruptcy law “exempt” from any action of creditors. They are preserved for you and your recovery and protected from collections, lawsuits, garnishments, and even State Court-ordered liens. The entire purpose of bankruptcy is to protect what you own from creditors, preserve income and create a clear path to financial recovery with no loss of assets. Federal bankruptcy laws offer absolute protection for:

Bankruptcy Exemptions

- Homes with equity now up to $250,000 per person

- Bank accounts and cash up to $13,900 per person

- Pension accounts

- Cars

- Personal belongings

- Alimony awards

- Social Security

- Life insurance

- Personal injury claims

- Worker’s compensation awards

- Other assets…

Stratford Bankruptcy Law Infographic

At the Law Offices of Neil Crane, we use all exemption laws to protect our client’s assets. We don’t lose assets in bankruptcy cases – all our cases protect our client’s assets from loss to creditors or court systems with precision and predictably known to our clients certainly and in advance of any bankruptcy filing. Our focused preparation is the essential element of all our successful bankruptcy cases. Attorney Neil Crane, Connecticut’s experienced bankruptcy attorney Stratford, CT trusts, will produce bankruptcy recoveries and results in one family and one case at a time.

Detailed Analysis and Services Under Chapter 7 and Chapter 13 at the Law Offices of Neil Crane

We understand and specialize in all the bankruptcy laws that apply to individuals, families, and small businesses. We’re a team of Stratford, CT bankruptcy lawyers committed to representing middle-class individuals and families who need a financial fresh start. We understand both Chapter 7 and Chapter 13 individual protections and provide more Connecticut residents with Chapter 7 and Chapter 13 services than any other firm. You need a dedicated bankruptcy attorney Stratford, CT residents have trusted for over 35 years. The attorneys and long-term support staff at the Law Offices of Neil Crane can provide proven Chapter 7 and Chapter 13 bankruptcy services.

Stratford Bankruptcy Law Statistics

According to a report by The Warren Group Bankruptcies in the state was 4,710 in the first half of 2011. That is down from 4,968 during the same period a year ago. According to statistics released by the Administrative Office of the U.S. Courts, the March 2022 annual bankruptcy filings totaled 395,373, compared with 473,349 cases in the previous year.

Preparation and Advanced Commitment are the Keys to Bankruptcy Success

All great cases are made in advance in our office under our knowledgeable guidance with your scripted assistance. We start each case with an outline of our approach and a detailed checklist of all the documents required on your end from start to finish. It’s predictable and it’s all laid out upfront in advance on Day One.

All bankruptcy law provides comprehensive, strong federal provisions that override all other state laws in favor of an individual’s right to obtain a financial fresh start. The laws and protections were written over 125 years ago, and they have provided a truly workable solution to millions of financial problems throughout Connecticut and the United States. Each provision works in conjunction with other laws under Chapter 7, Chapter 11, and Chapter 13 of the United States Bankruptcy Code, and all with the express purpose of creating financial recovery for individual families and small businesses.

The key elements in all bankruptcy relief processes in the Law Offices of Neil Crane are:

#1. Financial Recovery. Every case produces a new financial future and a new avenue to a fresh start. Under the Bankruptcy Code, regardless of your income or the amount of your debt, you have the right to rebuild, shed debt, and keep your belongings.

#2. Predictability. Every case under any personal chapter of bankruptcy produces results known and crafted in advance. Through analysis, preparation and in-depth documentation, great bankruptcy attorneys complete your case in the office, with all work done and all results known before any bankruptcy filing. It’s math, and it’s paperwork. At the Law Offices of Neil Crane, strong math and well-organized paperwork produce predictable and strong results.

#3. Respect. It’s difficult to ask for help, and it’s difficult to accept that you need help, so it’s hard to call our office even for free advice. The hardest part of any case is the scary first call to our office. We know you feel bad but we respect all our clients and appreciate their trust in our office. They are some of the hardest working good folks we’ve ever met. They motivate us each and every day. And the system itself respects them. No court hearings, no explanations necessary, no inquisitions – there’s a respectful one-time meeting, not in a courtroom, we’re with you, we’re prepared, and it takes less than ten minutes.

The Law Offices of Neil Crane Stratford Bankruptcy Lawyer

Zip Codes We Serve: 06607, 06614, 06615 and 06673

To learn more about the entire bankruptcy process and how it can bring you a fresh start, call the Law Offices of Neil Crane and speak with Attorney Neil Crane directly. He takes every call himself and also offers a free, in-depth follow-up consultation.

BANKRUPTCY PROTECTION AND MYTHS IN STRATFORD, CT

Bankruptcy is a set of Federal laws that provide rights for any Stratford individual or family to get guaranteed protection from creditors through any Chapter of Bankruptcy. Along with providing for special middle class borrowers’ rights, Bankruptcy law also created a fully funded Federal System dedicated to protecting borrowers.

The Bankruptcy system is a dedicated and well-run system that operates smoothly and efficiently for your benefit in conjunction with your experienced Stratford Bankruptcy lawyer at the Law Offices of Neil Crane. Your presence in Court is not required. Your case is run directly by your attorney in conjunction with the Bankruptcy official responsible for your case. Your case’s outcome is determined by the experienced expertise of our Stratford Bankruptcy lawyers.

All Chapters of Bankruptcy deal with providing you levels of debt relief from all types of debt. Bankruptcy law overrides all other laws and allows for the elimination or re-treatment of all forms of debt. Bankruptcy under Chapter 7 can fully eliminate all credit card debt and unsecured debt in full with no loss of assets. Chapter 13 can eliminate or restructure all forms of debt with no loss of assets. Chapter 13 has easier qualifications and broader debt coverage than Chapter 7. Chapter 13 saves homes from foreclosure. Proper Bankruptcy practice uses all the Bankruptcy laws and Bankruptcy System to readjust, lower and eliminate individual and family debt. It has no effect on what you own or your pay.

MYTH: IF I FILE BANKRUPTCY, I’LL LOSE MY STRATFORD HOME

One of the longest-standing, leading myths pushed by the Banks and financial companies that get rich off your payments is that if you file bankruptcy, you’ll lose your home. Nothing could be further from the truth. In fact, it’s just the opposite – Bankruptcy protects your home and makes it immune and off limits from all creditors. Bankruptcy law was written to prevent loss of assets to any creditors and their army of collection lawyers. By spending millions on perpetrating the myth of lost homes and cars, Banks and credit card companies keep their customers enslaved to their debt, in fear of losing assets.

FACT:

Bankruptcy filing protects assets and contains special laws that specify permanent protection for: Homes, cars, bank accounts, retirement accounts, pensions, life insurance and many other financially protected Exemption laws. Exemption laws assure permanent protection of your belongings free from legal actions or any creditors permanently and immediately upon the filing of any Chapter of Bankruptcy. To learn more about how you can protect your assets through a Bankruptcy filing, contact our Stratford Bankruptcy lawyers at the Law Offices of Neil Crane.

MYTH: IF I FILE FOR BANKRUPTCY, SOMEONE WILL HAVE CONTROL OVER MY LIFE.

Many people believe the Bankruptcy System comes to your house or stays involved in your future, or can take your future refunds or future earnings.

FACT:

The Bankruptcy System was created entirely for the purpose of helping you regain control of your own life. The system is there to protect you from creditors who seek to undermine your future and seize your assets. The system doesn’t control your life or touch your future. It protects the present from the past and ensures the future is your own. The Bankruptcy System doesn’t come to your home, and it doesn’t even require your presence in Court.

MYTH: IF I FILE BANKRUPTCY, EVERYONE WILL KNOW ABOUT IT – THEY’LL PUT MY NAME IN THE NEWSPAPER OR FIND OUT ONLINE

FACT:

Your Bankruptcy filing is not reported to others. It’s not news, it’s not public. Your neighbors don’t know and your employer won’t know. Chapter 7 and Chapter 13 individual Bankruptcies are registered with the Federal Court System and also on your credit report. Your creditors get notice but no one else receives notification from your bankruptcy attorney or the Bankruptcy Court. Your Bankruptcy case will be on a Federal docket system but that system requires special authorization, even for lawyers to gain access.

MYTH: BANKRUPTCY WILL KILL MY CREDIT SCORE. I’LL NEVER HAVE CREDIT AGAIN; I’LL NEVER HAVE A CREDIT CARD OR A CAR LOAN OR GET AN APARTMENT OR BUY A HOUSE.

FACT:

- Most people who seek Bankruptcy protection already have bad credit or are about to have bad credit. Because of overwhelming debt loads, even perfect payers no longer have perfect scores.

- The reduced debt-to-income ratio that results from a Bankruptcy filing makes you a better credit risk and will, with time, give you a higher credit score. And more importantly, your post-bankruptcy credit score will stay high and healthy.

- Credit cards and car loans are immediately available to post-bankruptcy clients at regular rates. Despite decades of scare tactics and information to the contrary, credit cards are immediately available to post-bankruptcy clients within weeks of a Bankruptcy filing – at regular rates. At the Law Offices of Neil Crane, we help all all our clients build post-petition credit scores, without building post-petition credit card debt.

The key to post-petition credit is proper use of credit cards and reduced debt loads. Take two or three major cards after your Bankruptcy. Use them each month and pay them in full each month. Don’t carry a balance on credit cards. It’s how the rich get richer and you get poor. Qualifying for a home loan without a co-borrower is a two-to-three-year period from a Bankruptcy filing. Even these time frames are shortening, but be careful. As with all credit, just because you qualify doesn’t mean it’s good for you.

MYTH: THERE IS NO MORE BANKRUPTCY PROTECTION FOR HIGHER INCOME STRATFORD RESIDENTS

FACT: NOT TRUE.

There are income requirements for obtaining full Bankruptcy relief under Chapter 7. Pursuant to the late 2005 Bankruptcy Amendments (BAPCPA) there are income requirements and standards for entry into Chapter 7. However, even higher income individuals and families can often still qualify for full debt elimination. Furthermore, even after BAPCPA all individuals and families of any income level are eligible for the full protection of Chapter 13.

Chapter 7 income qualifications are measured by your household median income or by Means Testing, which can also produce full Chapter 7 qualifications. While there were no income restrictions on Chapter 7 full Bankruptcy protection prior to 2005, our experienced Stratford Bankruptcy lawyers know how to produce the widest possible qualifications for Chapter 7 clients and the best Chapter 13 Bankruptcy Plans allowable, all based on your specific needs and circumstances. Bankruptcy relief and the full protections of the Bankruptcy System are still available to all Stratford, CT Bankruptcy clients, regardless of income.

To learn more about determining which Chapter of Bankruptcy is right for you, call the premiere Stratford Bankruptcy Lawyers and speak directly with Attorney Neil Crane. Attorney Crane has over 37 years of hands-on experience with all aspects of the Bankruptcy System, and he can turn your life around starting with the first call.

Stratford Frequently Asked Questions About Bankruptcy Law

Our Stratford, CT bankruptcy lawyer recognizes how overwhelming and complex the bankruptcy process can be. Many individuals find themselves facing financial challenges and are unsure of their options. To help clarify some common concerns, we’ve compiled a list of frequently asked questions related to bankruptcy law. Our goal is to provide clear and concise answers that can guide you through this difficult time. If you’re seeking assistance, remember that our team has been offering legal solutions since 1983, and is ready to help.

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as “liquidation bankruptcy,” allows individuals to discharge most of their unsecured debts, such as credit card bills, medical expenses, and personal loans. In a Chapter 7 case, a trustee is appointed to sell non-exempt assets, and the proceeds are distributed to creditors. One of the key benefits of Chapter 7 bankruptcy is the ability to start fresh financially, free from the burden of overwhelming debt. It’s important to note that not everyone qualifies for Chapter 7; eligibility is determined by a means test that evaluates your income and expenses.

What Is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy is known as a “reorganization bankruptcy.” It is designed for individuals with a regular income who can repay some or all of their debts through a structured repayment plan. Under Chapter 13, debtors propose a repayment plan that lasts three to five years, during which they make monthly payments to a trustee. This type of bankruptcy is beneficial for those who want to avoid foreclosure on their home or repossession of their car, as it allows for the catch-up of missed payments over time. Unlike Chapter 7, Chapter 13 does not require the liquidation of assets.

Can I Keep My House If I File For Bankruptcy?

Most homeowners considering bankruptcy will want to know whether filing will impact their ability to remain in their home. The answer depends on several factors, including the type of bankruptcy filed and the amount of equity in the home. In Chapter 7 bankruptcy, you may be able to keep your home if it is considered exempt under state or federal law. In Chapter 13 bankruptcy, you can keep your home as long as you continue making your mortgage payments and include any arrears in your repayment plan. Consulting with a Stratford bankruptcy lawyer can provide you with specific guidance based on your unique situation.

How Does Bankruptcy Affect My Credit Score?

Filing for bankruptcy will have a significant impact on your credit score. A Chapter 7 bankruptcy can remain on your credit report for up to ten years, while a Chapter 13 bankruptcy can stay for up to seven years. However, many individuals find that their credit scores start to improve shortly after the bankruptcy discharge, as they are no longer burdened by overwhelming debt and can begin to rebuild their credit. It’s important to focus on responsible credit habits post-bankruptcy, such as paying bills on time and keeping balances low, to gradually improve your credit score.

What Debts Are Discharged In Bankruptcy?

Not all debts can be discharged through bankruptcy. In general, Chapter 7 bankruptcy can discharge most unsecured debts, including credit card debt, medical bills, and personal loans. However, certain types of debt, such as student loans, child support, alimony, and most tax debts, are typically not dischargeable. Chapter 13 bankruptcy allows for the reorganization and repayment of debts, but the dischargeable debts are similar to those in Chapter 7. A legal professional can help you understand which of your debts may be discharged and what alternatives might be available for the debts that cannot be eliminated.

Help From Our Team

When making decisions and facing the outcomes of bankruptcy, it’s important that you understand the options that are available to you. At The Law Offices of Neil Crane, we are committed to helping you navigate this challenging time with compassion and expertise. If you have further questions or need personalized assistance, please don’t hesitate to reach out. A Stratford bankruptcy lawyer from our team is here to provide the guidance and support you need to regain financial stability. We offer 24/7 live call answering, so contact us today to schedule a consultation and take the first step toward a brighter financial future.