When You Need A Tax Law Lawyer

There are many different reasons that an individual or small business might need our Hartford, CT tax lawyer to help them with tax issues or general tax planning and compliance. The Law Offices of Neil Crane have been helping clients by successfully handling their tax, debt relief, credit card debt relief, debt consolidation, and bankruptcy cases since 1983. Because of our success, knowledge, and experience, we have earned a reputation that brings tax experts, CPAs, tax firms, accountants, and other tax professionals to us for advice, and they often refer their most difficult cases to us. If your financial health and your stress levels are suffering because of tax-related issues, especially ones that are forcing you to deal with the IRS or the Connecticut State Department of Revenue, there is a good chance that our tax debt lawyer can help alleviate at least some of these issues. Contact us today for a free consultation. Put our three decades of experience to work for you.

Internal Revenue Service Issues

Internal Revenue Service (IRS) issues can have serious consequences and should not be taken lightly. Many people who legitimately did not realize they were not following regularly changing tax laws also do not understand that tax law does not forgive ignorance no matter how innocent a defendant was in breaking tax law. If you have gotten a notice from the IRS or are already dealing with an audit, you likely know that issues with the IRS are stressful, time-consuming, and difficult to deal with. Our reputable Hartford CT tax attorney who has successfully helped clients with their IRS and other tax issues can help to alleviate much of this stress by putting their time and energy into dealing with your legal matters so that you don’t have to.

IRS Audits & Compliance

As you probably already know, the IRS is typically very strict about compliance with its rules and regulations. Individual taxpayers, small businesses, and corporations alike need to file taxes according to the IRS’s guidelines. Noncompliance can lead to severe tax penalties and in serious cases, they may even seek criminal action against those who do not follow tax law.

The IRS performs random IRS tax audits and even if you are not currently dealing with noncompliance with the IRS, our tax compliance lawyer can make sure that your taxes are in order and thus help you to protect your finances. Skilled tax lawyers are also able to help clients save money by confirming that the way their taxes are filed maximizes their deductions while keeping them in compliance with the IRS.

Skilled Tax Law Help

In addition to skilled tax law help, The Law Offices of Neil Crane offers skilled and experienced legal help for bankruptcy, foreclosure, collections lawsuits, credit card debt relief, and small business bankruptcy. For a highly skilled, experienced, and recommended Hartford tax lawyer, contact our compassionate staff to set up a free consultation.

Types Of Tax Cases We Handle

At The Law Offices of Neil Crane, we work with individuals and businesses facing a wide range of tax issues. With over 35 years of experience and more than 15,000 successful cases, our team focuses on practical legal strategies that address IRS problems, state tax issues, and financial stress related to tax debt. Every case is different, and our tax lawyers tailor their approach to meet the specific needs of each client.

IRS Tax Debt Resolution

We assist clients who owe back taxes to the IRS and need a path forward. Our Hartford tax lawyers work to develop repayment plans, settle debt where possible, and stop enforcement actions like levies or garnishments.

State Tax Issues

State tax problems can be just as serious as federal ones. We help clients resolve unpaid and delinquent Connecticut state income taxes, handle audits, and deal with enforcement actions by the Department of Revenue Services.

Tax Liens And Levies

When tax authorities file liens or initiate levies, it can threaten your income and property. We act quickly to negotiate release terms and prevent further harm to our clients’ finances and credit.

Payroll Tax Problems

Business owners who fall behind on payroll taxes face serious penalties. We represent employers who need to catch up on payments and resolve disputes without losing control of their business operations.

Audit Representation

Facing an audit can be stressful without support. Our tax lawyers represent clients during both IRS and state audits, helping them prepare documentation, respond to requests, and protect their rights throughout the process.

Offers In Compromise

For those who qualify, an Offer in Compromise can reduce the total amount owed to the IRS. We evaluate financial eligibility and prepare proposals that meet IRS standards.

Installment Agreements

Many taxpayers benefit from structured payment plans. We help clients set up reasonable monthly payments to resolve large balances over time, avoiding more aggressive collection efforts.

Tax Penalty Relief

Penalty charges can often be reduced or removed with the right request. We help clients present valid reasons for relief, including financial hardship or reasonable cause.

Business Tax Issues

Businesses dealing with sales tax, corporate tax filings, or classification issues come to us for reliable legal support. We guide owners through dispute resolution and long-term planning.

Tax Discharge In Bankruptcy

In some situations, tax debt can be discharged through bankruptcy. We review client history and timing to determine whether this is a viable option under current law.

Speak With Us

Working with our Hartford tax lawyers means having someone on your side who understands both the legal system and the real-world impact of tax debt. Our team is ready to assist with your situation. If you’re looking for a tax attorney in Hartford with decades of experience and a strong record of results, contact us today. Our team will review your situation, help you explore all available legal options, and guide you through each step with confidence and care.

6 Common Reasons People Face Tax Problems

Our tax relief attorneys have worked with individuals and families throughout Connecticut who are dealing with tax-related issues. Over the last 35 years, we’ve seen firsthand how easy it is for someone to fall behind or feel overwhelmed by tax obligations. Whether someone is employed, self-employed, or running a business, there are several recurring reasons people end up reaching out to our Hartford, CT tax lawyers for help.

Tax issues can develop slowly or appear quickly depending on the situation. Here are six of the most common causes we see when clients come to us for help.

1. Failing To File Tax Returns

One of the most common situations we encounter involves people who haven’t filed tax returns for one or more years. Sometimes they didn’t realize they were required to file. Other times, they were dealing with a personal hardship or were unsure how to handle a complicated return. Not filing can lead to penalties, interest, and enforcement actions from the IRS or the state.

2. Mistakes In Reported Income

Another frequent issue involves errors in reported income. This can happen when someone forgets to include a second job, freelance work, or a contract position. The IRS receives income information from employers and financial institutions and compares it to what is reported on tax returns. Any mismatch can trigger a notice or audit, and even simple mistakes can create long-term problems if not addressed.

3. Unpaid Payroll Taxes

Business owners, especially those with employees, sometimes fall behind on payroll tax payments. This is a serious matter, as the IRS views unpaid payroll taxes as a priority. It’s not uncommon for a struggling business to delay paying these taxes to cover more immediate costs, but this often leads to penalties and personal liability for the business owner. We frequently assist clients in resolving these matters before enforcement gets more aggressive.

4. Problems With Estimated Tax Payments

People who are self-employed or work as independent contractors are responsible for making quarterly estimated tax payments. Many people aren’t used to calculating and sending these payments, and they either pay too little or miss payments entirely. This can lead to a large year-end tax bill, along with interest and penalties. Over time, the debt can grow and become more difficult to manage.

5. IRS Collection Activity

Some clients reach out to our Hartford tax lawyers only after the IRS has begun collection efforts. This can include wage garnishment, bank levies, or liens against property. By the time these actions begin, the underlying issue has usually been developing for a while. Responding early and understanding available options can make a significant difference in the outcome.

6. Financial Hardship Or Personal Crisis

Life events like job loss, medical issues, or divorce often lead to unpaid tax debt. When someone is already dealing with financial pressure, taxes may fall to the bottom of the list. But tax debt doesn’t go away on its own. In fact, it often grows with added penalties and interest. We work with people to address the underlying financial issues and find a legal path forward, often through bankruptcy or negotiated agreements.

Speak With Us

We understand how stressful tax problems can be. Attorney Neil Crane has been one of Connecticut’s leading providers of Chapter 7, 11, and 13 bankruptcy relief for over 35 years. He’s handled over 15,000 cases and is passionate about helping people stay in their homes and regain financial control. Tax issues often overlap with other financial challenges, and our firm is prepared to address both short-term and long-term needs.

If you’re dealing with tax debt or IRS notices, it may be time to speak with our Hartford tax lawyer team. We help individuals and businesses resolve tax problems and protect what matters most. Whether your issue is new or has been building for years, we can help you understand your legal options and take clear, effective steps forward. Contact our team today to speak with our team of lawyers who’s ready to listen and help you take action.

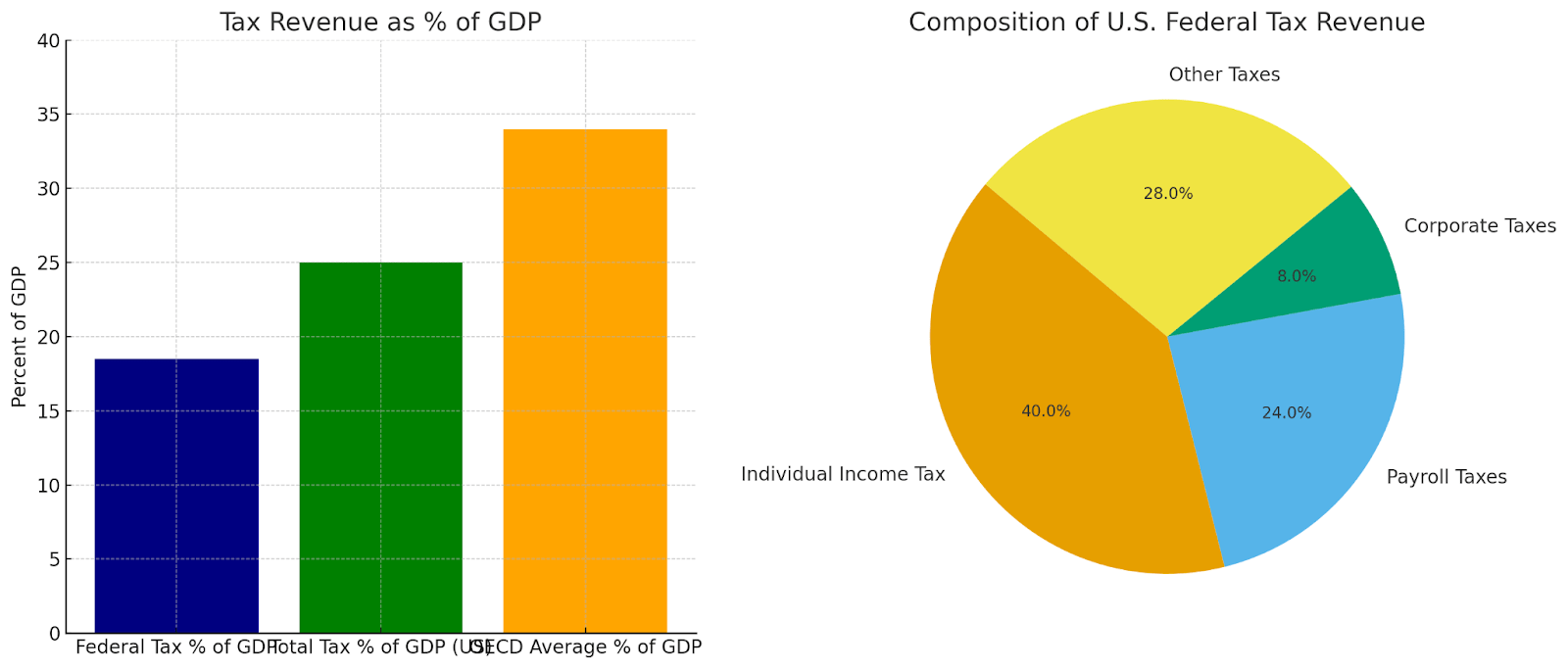

Hartford Tax Infographic

Hartford Tax Statistics

Federal tax revenue generally accounts for 17%–20% of Gross Domestic Product (GDP) in the United States. The total tax-to-GDP ratio (including federal, state, and local taxes) in the U.S. is about 25%, which is lower than the OECD average (~34%).

Regarding the composition of total federal tax revenue, roughly 40% comes from individual income taxes, about 24% from social insurance (payroll) taxes, around 8% from corporate income taxes, and the remainder from consumption, property, and other taxes.

Large tax expenditures (special deductions, credits, preferential rates) are also sizeable: they can amount to 6% or more of GDP, representing a substantial portion of forgone revenue.

Hartford Tax FAQs

Tax issues can affect both individuals and businesses, often creating stress and uncertainty about the future. Whether you are dealing with unpaid taxes, IRS notices, unfiled returns, or state tax matters, getting the right legal guidance can make a difference in the outcome. With over 35 years of experience and more than 15,000 successful cases, we have the knowledge and practical experience to address a wide range of tax problems. Our Hartford, CT tax lawyer team works closely with clients to fully understand their circumstances, explain their options in plain language, and create a plan aimed at resolving issues efficiently. Below are some common questions we hear from clients and our straightforward answers, based on years of helping people in situations just like yours.

How Can A Tax Attorney Help Me With Back Taxes?

We assist clients in resolving unpaid tax balances through structured payment plans, negotiations, or other legal solutions. Back taxes can result in liens, wage garnishments, or other enforcement actions. Our goal is to address the matter quickly and protect your financial stability.

What Should I Do If I Receive A Notice From The IRS?

It’s important to carefully review any IRS notice and respond within the given timeframe. We meet with you to explain what the notice means and develop a plan of action. Taking timely steps can prevent additional penalties and help control the situation before it escalates.

Can A Tax Lawyer Help Reduce Penalties And Interest On Tax Debt?

In many cases, yes. We may be able to request penalty abatement or negotiate for reduced interest when certain conditions are met. We gather the necessary information, prepare formal requests, and communicate with the IRS or state tax authorities to present your case effectively.

What If I Have Unfiled Tax Returns For Several Years?

Our tax lawyers assist clients in filing past-due returns to prevent further legal or financial consequences. Leaving returns unfiled can lead to enforcement actions, so addressing them promptly is important. We help collect the required documents, prepare the filings accurately, and represent you in discussions with tax agencies.

Can A Tax Attorney Handle State Tax Issues As Well As Federal Ones?

Yes. We represent clients in both Connecticut state and federal tax matters, including audits, assessments, tax lien releases, and payment arrangements. We work to address your situation from every legal angle to find a solution that works for you.

Tax Law Glossary

When facing IRS notices, unfiled returns, or other tax-related matters, having the right information makes a difference. Below are five key terms we believe are essential for anyone working with our Hartford, CT tax lawyer to understand. These terms often arise during our legal consultations and are critical to resolving tax issues effectively.

IRS Tax Debt Resolution

This term refers to the legal process of addressing unpaid balances owed to the Internal Revenue Service. Tax debt can accumulate due to unfiled returns, underreported income, or missed payments. If left unresolved, it can lead to severe enforcement actions such as wage garnishment or bank levies. Legal resolution options vary depending on the individual’s financial condition and history. Some taxpayers may qualify for structured repayment plans, while others may be eligible to negotiate a reduced balance through a formal IRS program. We assist clients by reviewing their full tax record, identifying the appropriate resolution route, and preparing and submitting the required documentation. We also represent our clients in direct communication with the IRS to pursue resolution while protecting their legal rights.

Offer In Compromise

An Offer in Compromise is a federal tax relief program that allows qualified taxpayers to settle their IRS tax debt for less than the full amount owed. This option is typically pursued by individuals or businesses experiencing financial hardship who cannot reasonably repay their tax liability in full. The IRS evaluates several factors before accepting an offer, including income, expenses, asset equity, and overall ability to pay. The application must include accurate financial disclosures and a reasonable settlement proposal. Approval is not guaranteed and depends on strict eligibility standards. When appropriate, we help clients assess their eligibility, develop a compliant offer, and manage all communication with the IRS to pursue a resolution that fits their financial situation.

Installment Agreement

An Installment Agreement is a formal payment arrangement with the IRS or Connecticut’s Department of Revenue Services that allows taxpayers to pay their outstanding balances in monthly installments. These plans are beneficial for individuals or small businesses unable to pay their full tax debt at once but who can manage monthly payments over time. Agreements are based on the taxpayer’s ability to pay and may differ in structure, length, and interest rates. Some payment plans may require full financial disclosure, while others are streamlined based on the balance due. When clients come to us for help, we guide them through the process of determining the best payment structure, preparing the necessary financial information, and submitting the proposal to the taxing authority. We also follow up to monitor plan status and resolve any enforcement actions.

Tax Lien

A tax lien is a legal claim made by the government against a taxpayer’s property due to unpaid tax debt. This public record serves to secure the government’s interest in a taxpayer’s assets, including real estate, vehicles, or personal property. Once a lien is filed, it can affect credit ratings and hinder the sale or refinancing of assets. Tax liens do not automatically result in asset seizure but can create long-term financial obstacles. Resolving a tax lien usually requires either full payment of the underlying tax debt or an accepted agreement, such as a payment plan or discharge through bankruptcy if eligible. We help clients explore their legal options, including lien withdrawal or subordination, depending on their financial goals and available remedies under the law.

Payroll Tax Liability

This term relates to the responsibility of employers to withhold and remit specific employment taxes to the federal and state government. Payroll taxes include Social Security, Medicare, and federal income tax withholdings. When a business fails to submit these taxes, the IRS considers it a serious violation. The agency may assess civil penalties or pursue the business owner personally through the Trust Fund Recovery Penalty. We frequently represent business owners who have fallen behind on payroll tax obligations due to operational challenges. Our approach includes assessing the amount owed, halting collection actions, and negotiating manageable repayment structures. In some cases, we pursue compromise options to reduce the liability or eliminate future penalties.

If you’re experiencing financial strain from IRS actions, payroll tax problems, or unresolved tax filings, we’re here to help. At The Law Offices of Neil Crane, we’ve worked with individuals and businesses across Connecticut to create reliable legal paths out of tax-related stress. Schedule a consultation to speak directly with our Hartford tax lawyer who can evaluate your case and recommend a course of action.

Let us review your situation and provide you with clear, direct legal support tailored to your financial goals. Contact our office today.

Let Us Help

At The Law Offices of Neil Crane, we understand that tax issues can be overwhelming, but they don’t have to be faced alone. We are committed to giving each client the attention and legal support they need to move forward. Whether your challenge involves IRS debt, state tax concerns, or long-overdue filings, our team is ready to step in with the resources and experience necessary to protect your rights. If you need our trusted Hartford tax lawyer to help with back taxes, IRS notices, or other tax concerns, contact us today to take the first step toward resolving your matter and building a more secure financial future.